- Home

- Estate Planning goals and objectives

Seven important estate planning goals and objectives

Estate planning goals and objectives help families think ahead, reduce confusion, and make decisions easier for the people who will one day carry responsibility on their behalf.

Taking the time to plan — and to clearly express your wishes — can prevent your family from feeling lost, disorganized, or overwhelmed at a time when emotions are already high.

Below are seven estate planning goals and objectives that help bring clarity, reduce stress, and make the entire process easier for the people you care about.

1. Provide adequately for your spouse and dependents

One of the most important estate planning goals is ensuring that your spouse and dependents are financially supported and cared for according to your wishes.

Without clear planning, decisions about support, access to funds, and timing may be delayed or restricted.

2. Distribute your assets according to your wishes — not the courts

An estate plan allows you to decide who receives what, and when.

Without one, distribution rules are determined by legislation, not by your intentions — which can lead to outcomes you never wanted.

3. Choose guardians for minor children

If you have minor children, estate planning allows you to decide who will care for them.

Without clear direction, the courts may be required to step in — often at the worst possible time for a family.

Estate Planning Goals and Objectives: Why They Matter

Estate planning isn’t just about documents. It’s about making intentional decisions now so your family isn’t forced to make rushed or difficult choices later — often under pressure, uncertainty, or court involvement.

These goals provide a framework for thinking through what matters most and how to protect the people who will be affected by your decisions.

Why this matters in real life

Here’s where planning (or the lack of it) stops being theoretical.

Here’s why these estate planning goals and objectives matter in real life.

Danielle understood the importance of setting estate planning goals and objectives. On paper, her situation seemed straightforward.

She had no children, had named a longtime friend as executor, and had clearly outlined how her assets should be divided. She also had a power of attorney in place and a succession plan to ensure her business could continue until a buyer was found.

But Danielle’s motivation came from something much deeper.

When her father died at age 39, Danielle was only 12. There was no will.

At the time, her grandfather’s estate had not been settled. Neither had her great-grandfather’s.

“We’re talking about three generations of estates not settled — and the one thing they all had in common was that there was no will.”

Because there were no instructions, decisions about Danielle and her brother were made in the parking lot of a funeral home. Different relatives took responsibility for each child.

Her upbringing turned out well — thanks to caring relatives — but it came at an enormous emotional and administrative cost. Because there was no will, the government controlled the money.

Every expense required court approval.

This is where things get complicated — and where clear estate planning goals can prevent unnecessary hardship.

Setting estate planning goals and objectives makes it easier on your family

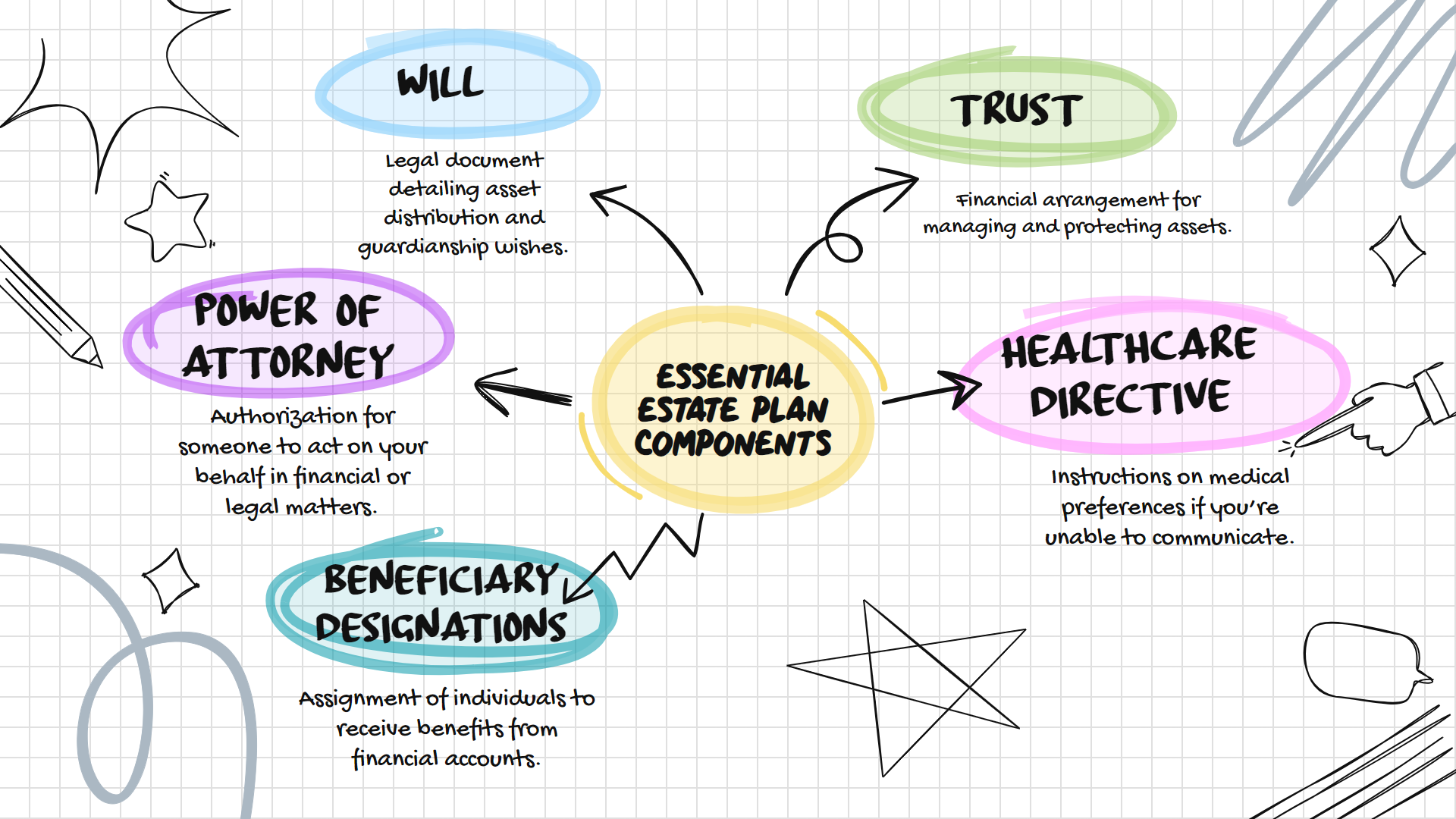

4. Choose who will manage your affairs if you cannot

A power of attorney allows you to decide who will manage your financial and legal affairs if you become incapacitated.

Without one, families may face delays, legal hurdles, or court involvement at an already stressful time.

5. Reduce costs and administrative burden

- Reduce or defer taxes

- Reduce probate, legal, and executor fees

- Provide funds for final expenses and liabilities

It can also ensure funds are available to cover final expenses and outstanding liabilities.

6. Reduce settlement time and complications

Clear estate planning goals and objectives can significantly reduce the time it takes to settle an estate.

They also help minimize disputes, confusion, and delays — especially when business interests, charitable intentions, or multiple beneficiaries are involved.

7. Estate planning is not just for the wealthy

Estate planning is not only for people with large estates.

People of any age can use it to:

- Decide who will inherit their property

- Choose who can make medical or financial decisions on their behalf

- Make their wishes known clearly

Even young adults — including single individuals just starting out — should have basic documents in place.

Recent global events have only reinforced how important it is to be prepared for the unexpected, at any stage of life.

A calm next step

If reading through these estate planning goals and objectives made you think about your own family — and how responsibility might one day shift — there is a simple, structured way to work through this without pressure or overwhelm.

The Family Legacy Blueprint is a practical framework designed to help families organize important information, have clear conversations, and reduce stress long before decisions are forced by time or circumstance.

- Home

- Estate Planning goals and objectives