Inheritance What does it mean?

Leaving a Legacy for Your Loved Ones

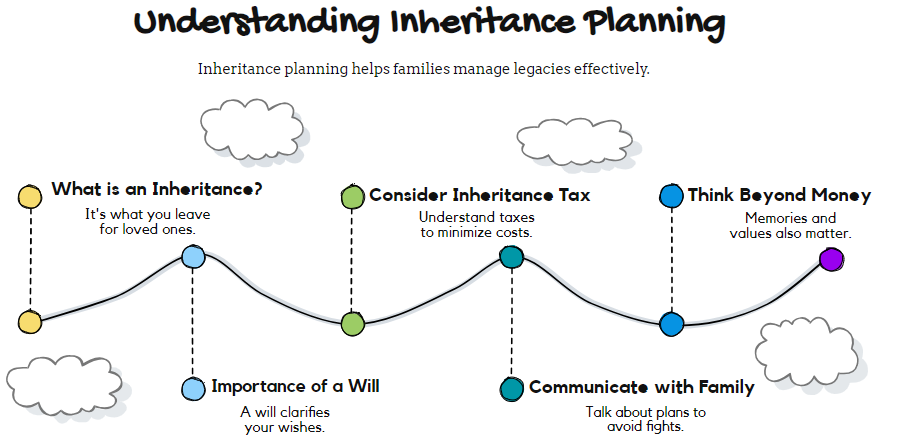

Inheritance What does it mean? It's what you leave behind for your loved ones after you pass away. This can be money, property, or even special items like jewelry or family heirlooms. Thinking about inheritance can be hard, but planning ahead can prevent family disagreements later.

For Ray and Angela, leaving a clear inheritance plan for their children and grandchildren is important.

This plan should outline who gets what and how it will be divided. Open communication with their family can prevent fighting and ensure everyone feels heard.

Leaving an inheritance is about more than just money. It's about providing for your family's future and sharing your legacy. It's also about making the process as smooth as possible for those you leave behind.

Receiving an inheritance can be a mixed blessing. It can provide financial security but also bring emotional challenges. Understanding what to expect can help beneficiaries navigate this time.

Planning for a financial windfall requires careful consideration. It's wise to seek professional advice to manage the inheritance wisely and avoid potential pitfalls.

Inheritance isn't always about money or property. Sometimes, the most valuable inheritance is the memories, traditions, and values passed down through generations.

So, inheritance what does it mean? It means different things to different people. But at its core, it's about the legacy we leave behind and the impact we have on our loved ones.

For Ray and Angela, a crucial step is creating a will. This legal document outlines their wishes for their assets and appoints an executor to manage the process.

They should also consider how does inheritance tax work. Understanding estate taxes and inheritance tax can help them minimize the tax burden on their heirs. Learning how to avoid inheritance tax, when possible, can preserve more of their assets for their family.

Open communication is key. Ray and Angela should discuss their plans with their children and if they are old enough include the grandchildren, addressing any questions or concerns they may have. This can prevent family fights and disagreements later on.

For the beneficiaries, receiving an inheritance can be a significant event. It's important to take time to process the emotional impact and seek support if needed.

Financial planning is essential. Beneficiaries should create a budget and prioritize their financial goals. Seeking professional advice can help them make informed decisions about investing and managing their inheritance.

Inheritance: what does it mean for those who receive it? It can mean a chance to pursue their dreams, secure their financial future, or simply have peace of mind.

Inheriting non-financial assets, like family heirlooms or traditions, can be just as meaningful. These items carry sentimental value and connect us to our family history.

Inheritance what does it mean?

Case Study: The Smiths, like Ray and Angela, wanted to leave a clear inheritance. They communicated their plans with their children, minimizing potential conflicts. They also consulted with a financial advisor to understand how does inheritance tax work and explore ways to minimize it.

By addressing these issues proactively, the Smiths ensured a smooth transition and preserved family harmony. This illustrates the importance of planning and communication in inheritance matters.

For Ray and Angela, documenting their wishes clearly is vital. A well-drafted will, combined with open communication, can prevent misunderstandings and ensure their wishes are respected.

They should also consider setting up a trust. A trust can provide greater control over how their assets are distributed and can offer tax advantages.

Beneficiaries should also be aware of their rights and responsibilities. Understanding the legal and financial implications of inheritance can help them navigate the process confidently.

Finally, remember that inheritance is more than just a financial transaction. It's about the bonds of family and the legacy we leave behind.

By planning carefully and communicating openly, families can ensure that inheritance is a source of blessing, not conflict. This allows the focus to remain on honoring the memory of loved ones and cherishing the legacy they leave behind.

Inheritance what does it mean for a

blended family with no plan

Here's what happens when you don't plan ahead for inheritance, especially in blended families:

Let's talk about the mess that happens when someone passes away without a will, particularly in families where there are stepchildren, second marriages, or half-siblings. Not having a plan can create huge problems that could tear families apart.

Here are seven serious issues everyone should know about:

1. The State Takes Control

Your family loses the power to decide who gets what. Instead, the state's laws determine how your stuff gets split up. These laws might not match what you would have wanted at all. It's like letting a stranger decide how to divide up your family treasures.

2. Stepchildren Could Get Nothing

In most places, stepchildren have no legal right to inherit anything unless they were legally adopted. This means kids you helped raise and love could end up with nothing, while others might get everything.

3. Ex-Spouses Might Pop Up

Without clear instructions, former spouses might try to claim parts of your estate, especially if divorce papers weren't perfectly clear about who owns what. This can lead to ugly court battles.

4. Family Fighting

When there's no clear plan, relatives often fight over everything - from valuable items to simple family photos. These arguments can destroy relationships and turn brothers and sisters into enemies.

5. Extra Costs and Time

With no will, your estate goes through a longer court process called probate. This means more money spent on lawyers and more time before anyone gets anything. Your family might wait months or even years.

6. Kids' Guardian Problems

If you have young children, not having a will means you don't get to choose who raises them if something happens to you. The courts decide, and it might not be the person you would have picked.

7. Business Troubles

If you own a business, not having a plan could force your family to sell it quickly, often for much less than it's worth. Or worse, your business might get split up in ways that make it impossible to keep running.

Think about the story of your grandfather's watch - without a will, it might not go to the person who would cherish it most. Or consider your family photos - they could end up with someone who doesn't even want them, while others who desperately want them can't have them.